by Admininsta | May 2, 2025 | Instanode |

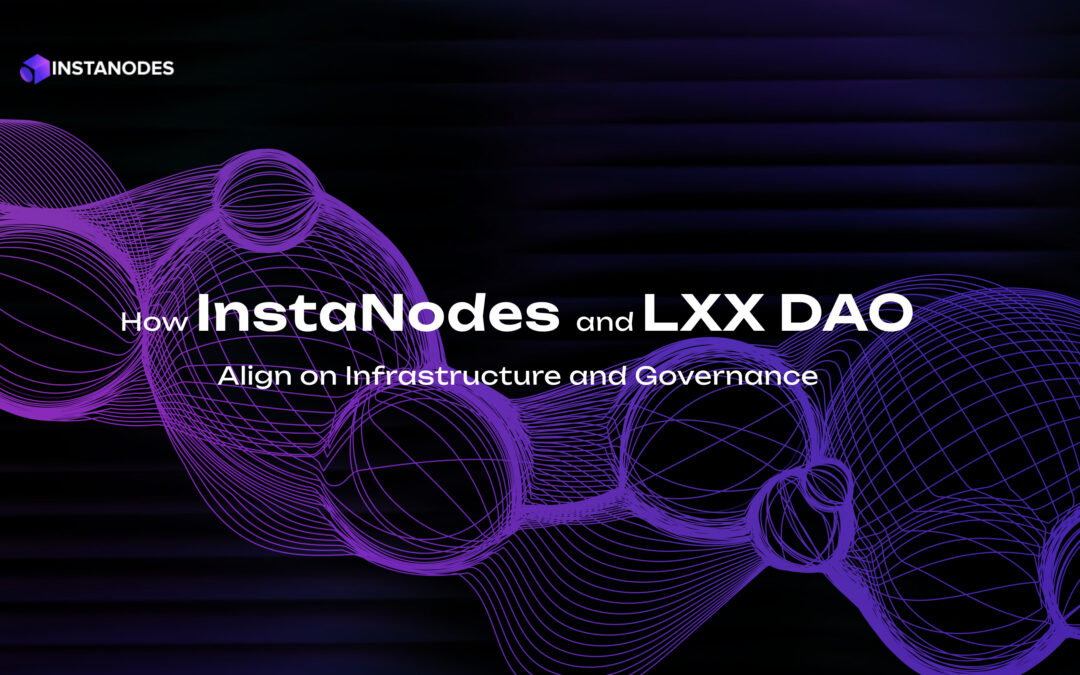

Within the fast-paced world of Web3, the scalability and smooth functioning of decentralized ecosystems depend on two core factors: reliable infrastructure, backed by nodes in blockchain ,and effective governance. When you run a DAO, the demand for stable, effective, and scalable blockchain nodes becomes unavoidable. It’s also noticeable that the community driving a DAO will demand control over the protocol and platform it supports. That’s what LXX DAO intends to do by fulfilling the demands of the decision makers. Using a dApp blockchain node that never goes down smoothens the validation process and enhances the speed of operations.

But how has LXX DAO made it possible?

It has partnered with Instanodes, a blockchain infrastructure provider for blockchain network’s to boost its community-led governance ecosystem. This partnership aims to strengthen the foundational integrity of the blockchain ecosystem by combining democratic governance with dependable node operation.

LXX DAO: Empowering Community-Driven Decision-Making

LXX DAO brings a transformative change in the governance of blockchain. Token holders are given the ability to contribute their share in determining the future of the protocol through an open and decentralized governance system. Whether it is updating the protocol or distributing the treasury, every major alteration falls under the community vote. Essentially, no centralized power can have authority.

LXX signifies a significant advancement from conventional governance frameworks. It harmonizes incentives and decentralizes authority to mitigate the risks linked to centralized management, which fosters greater trust within the ecosystem. Importantly, DAOs ensure protocols evolve to respond to their true needs in a community, and not as only for some group of particular stakeholders.

Any governance model becomes effective only when it is backed by reliable and secure nodes in blockchain. It means that the role of a reliable node provider cannot be overlooked while running a DAO. Each dApp blockchain node powers DAO operations by validating transactions, enabling decentralized governance, ensuring transparency, and maintaining consensus, thus allowing trustless coordination and execution of proposals on-chain.

Main Features LXX DAO

LXX DAO is a decentralized autonomous organization built on the Polygon blockchain, leveraging nodes in blockchain to ensure security, transparency, and distributed control. Here are the key features that set it apart from the rest:

- Governance is fully community-driven, with all decisions made democratically through on-chain voting, eliminating centralized management.

- Utilizes smart contracts to automate rules, fund management, and decision execution, making processes transparent and immutable.

- No KYC is required, protecting user privacy and allowing anonymous participation for all members.

- Offers a suite of crypto services, including crypto banking, anonymous debit cards, P2P cash pools, a crypto online shop, and a crypto payment system for paying bills with cryptocurrency.

- Treasury management is handled via smart contracts, ensuring secure custody and transparent allocation of funds.

- Advanced encryption and cryptographic techniques secure transactions and access to funds, making manipulation nearly impossible.

- All proposals, votes, and financial movements are publicly accessible, fostering trust through full transparency.

- Members retain full control over their assets, with no single authority able to dissolve or manipulate the DAO.

- LXX DAO’s infrastructure and use of nodes in blockchain enable unstoppable, borderless participation and collaboration for its global community.

Ready to power your DAO, dApp, or Web3 startup with reliable nodes?

Explore InstaNodes today and deploy your first node in minutes—no dev ops needed.

Get Started Now

Reliable Nodes: The Backbone of Blockchain Security and Integrity

Nodes in blockchain are the basic building blocks that keep a network healthy and intact. They verify transactions, impose consensus mechanisms, keep full or partial records of the ledger, and make the blockchain operational without downtime or compromise. In a decentralized system, all dApps depend on these nodes to remain connected to the network and deliver real-time, reliable information.

Operating a dApp blockchain node is no small task. It needs round-the-clock availability, good security, and the ability to scale to meet increased demand. For a DAO like LXX, whose reputation rides on seamless access to the blockchain, unreliable node infrastructure would spell disaster, from voting to managing the treasury.

In this regard, the node reliability has a direct effect on the validity of DAO operations. Without an uninterrupted node access, governance proposals will get stuck, dApps become out of sync, and users experience diminished experiences. This is where Instanodes steps in by taking control of LXX nodes.

The Role of Instanodes in Ensuring Network Reliability

Instanodes breaks down the technical hurdles of running blockchain nodes. It provides a seamless, scalable solution for projects, validators, and DAOs to easily deploy and manage nodes. Whether you’re deploying a new dApp, staking in a DeFi protocol, or voting on governance, InstaNodes keeps you connected and in sync with the network.

Instanodes keeps dApp blockchain nodes in a position to withstand downtime, attacks, or congestion through real-time monitoring and enterprise-level security. In the case of LXX DAO, that means 24/7 availability of nodes for governance execution, interaction with smart contracts, and further ecosystem involvement.

One of the most interesting aspects handled by Instanodes is the promise of scalability. The more the LXX DAO community increases in size and its on-chain activities increase, Instanodes makes sure the node infrastructure scales up with it, never prioritizing performance or security in the process.

Why the InstaNodes-LXX DAO Alliance Matters

The partnership between Instanodes and LXX DAO is not merely technical—it’s philosophical. Both parties share a belief in the strength of decentralization and community power. Instanodes offers the technological infrastructure for a trustless ecosystem, and LXX DAO makes sure that this ecosystem is democratically and transparently governed.

Here’s why this partnership is pivotal for the future of decentralized ecosystems:

- Reliability Meets Accountability: While we manage the infrastructure and LXX DAO covers governance, consumers enjoy an infrastructurally sturdy yet ethically open system.

- Enhanced dApp Performance: Developers managing LXX DAO’s ecosystem can have a hassle-free experience with high-performing dApp blockchain nodes provided by Instanodes, as there will be no scope for downtime. It will guarantee lower latency and smoother user experiences.

- Scalable Governance: As LXX DAO adds more community members and initializes new projects, InstaNodes’ adaptive infrastructure makes governance functions scale undeniably.

- Security-First Infrastructure: Blockchain’s guarantee of decentralization and immutability can only be realized through secure nodes. We provide enterprise-level security, and LXX DAO’s activities are kept robust against failures and attacks.

- Ecosystem Growth: With this alliance, both partners position themselves to onboard more developers, users, and protocols—amplifying adoption and strengthening the Web3 movement.

Conclusion

The collaboration between Instanodes and LXX DAO is a bold move towards revolutionizing decentralized applications with trustworthy infrastructure and community-led governance. By tapping into the expertise that they both bring, we are elevating the benchmarks for scalability, security, and transparency in blockchain systems.

Our alliance shows that when you pair reliable nodes in blockchain with decentralized governance, you’re not just supporting a protocol—you’re creating an ecosystem that can grow, evolve, and flourish.

by Admininsta | Apr 29, 2025 | Instanode |

When two entities choose to form partnership, they are mutually benefited, as they become strong enough to counter their flaws and provide improved services to their customers. However, technological collaboration is not always intended to provide improved product and services. At times, the intention is to optimize the technical infrastructure and provide improved security.

The strategic alliance between Instanodes (the industry’s best blockchain node provider) and Zebpay (top cryptocurrency exchange platform) is all about making blockchain infrastructure stronger, thereby enhancing the transaction processing power and offering a smoother and more efficient trading experience to the investors.

General Introduction

We know that blockchain is the backbone of cryptocurrency business, and blockchain technology is developing non-stop. It organically provides growth of ecosystems and stability of cryptocurrency trading platforms. Blockchain node providers have the key role in meeting the increasing demand for cryptocurrency trading services, since they construct never-down technological infrastructure and contribute to the improvement of reliability.

A few months back, Instanodes and Zebpay formed a strategic alliance, which was a major milestone for solving the technical issues of the renowned cryptocurrency exchange platform. Instanodes provides cutting-edge node solutions that improves Zebpay’s performance, security, and reliability. Consequently, the exchange has achieved improved potential to provide more value to its users.

Introduction to Zebpay

Zebpay, which was launched in 2015, has come to be recognized as a reliable cryptocurrency trading platform with millions of customers operating in several nations. Prioritizing ease of use, Zebpay provides trading options for numerous cryptocurrencies, in addition to staking, lending, and a secure wallet option.

Zebpay’s focus on security, compliance, and innovation has made it a go-to option for both new and seasoned traders. The exchange has handled billions in transaction volume and continues to grow its offerings to address the changing needs of the crypto community.

With regulatory compliance being at the center, Zebpay adopts strong KYC/AML processes while ensuring a smooth user experience. The intuitive interface of the platform, combined with sophisticated trading tools, has helped the platform gain a large user base in a competitive market environment.

A Brief About Instanodes

Instanodes has emerged as the industry’s best blockchain node provider, offering high-performance, scalable, and reliable node infrastructure for multiple blockchain networks. The company specializes in delivering enterprise-grade node solutions that power cryptocurrency exchanges, DeFi platforms, and blockchain applications.

What sets Instanodes apart from other blockchain node providers is its commitment to uptime, performance, and technical excellence. With a distributed network of nodes across strategic locations worldwide, Instanodes ensures minimal latency and maximum reliability for its customers. The company’s technical team comprises blockchain experts with extensive experience in network architecture, security, and optimization.

Instanodes’ comprehensive suite of services includes dedicated nodes, shared nodes, archive nodes, and custom solutions designed to meet specific requirements of enterprises. Our infrastructure supports a wide range of blockchain protocols, including Ethereum, Bitcoin, Binance Smart Chain, Solana, and many others, making us a versatile partner for businesses operating across multiple blockchains.

How Instanodes is Solving Zebpay’s Pain Points

Before this alliance, Zebpay had a number of infrastructure issues, typically faced by any any cryptocurrency exchange platform. These were:

During times of high market volatility and trading volumes, the exchange saw heightened pressure on its node infrastructure, which could impact transaction processing times. Instanodes offers a modular and flexible architecture that Zebpay can scale up or down on demand, without accumulating unnecessary technical debt.

Zebpay takes advantage of Instanodes’ low-latency architecture that enables quicker API calls, smoother wallet management, and instantaneous transaction verifications. This enhances user experience and reduces latency in trade execution.

- Network stability concerns

Ensuring consistent uptime and performance across all supported blockchain networks presented ongoing challenges. With proactive monitoring and live alerts, we ensure that any errors are fixed before they affect Zebpay’s users. Our support team provides instant help for any technical questions.

As Zebpay expanded its offerings to include more blockchain networks, the technical complexity of maintaining diverse node infrastructure increased substantially. Instanodes provides full support for setting up the node infrastructure for diverse types of blockchains, whether they are compatible with EVM or not.

Instanodes solves several types of issues by offering high-performance, dedicated nodes with enhanced reliability and throughput. The collaboration provides Zebpay with access to Instanodes’ distributed network around the world, leading to faster transaction speeds and lower latency for users across the globe.

Being the best blockchain node provider, Instanodes enables Zebpay to concentrate on making the necessary improvements in its trading platform while entrusting the complicated infrastructure management to blockchain experts. This strategic separation of tasks enables both firms to focus on their strengths.

How This Partnership Enhances Mutual Growth

The partnership between Instanodes and Zebpay brings about substantial value for both organizations and their users. For Zebpay, integration with Instanodes’ advanced node infrastructure means better performance of the platform, increased reliability, and shorter processing times for transactions. All these benefits find direct application with Zebpay’s users, who can experience an improved seamless trading experience, especially during times of high-market volume.

The partnership also allows Zebpay to expand into new blockchain networks and cryptocurrencies more quickly without the cost of establishing and supporting further infrastructure. This agility means the exchange can react faster to new market trends and user needs, possibly unlocking new growth opportunities.

For Instanodes, collaborating with Zebpay presents opportunities for deeper penetration within the exchange ecosystem and establishes its position as one of the top blockchain node providers. It also provides insightful information regarding the actual needs of a high-volume cryptocurrency exchange platform, enabling the team to continuously improve and optimize their services.

For Zebpay, the partnership guarantees its backend infrastructure future-proof so that the platform can onboard new customers, add new blockchains, and introduce new features without the threat of infrastructural constraints.

Together, the two companies seek to set new standards for infrastructure quality and reliability within the cryptocurrency space. Through the union of Zebpay’s exchange experience and Instanodes’ technical capabilities, the partnership provides a platform for innovation that may be useful to the wider blockchain community.

Wrapping it Up

As the mass acceptance of digital currencies in increasing day by day, the load on crypto exchanges will keep increasing. The robust infrastructure will remain a key determinant of success for exchanges and other service providers. In the current pretext, the collaboration between Instanodes and Zebpay, both well-positioned organizations in their niches enhances future growth opportunities, apart from delivering immediate benefits to their users.

The strategic alliance between Instanodes and Zebpay is a significant move in the cryptocurrency infrastructure space. With this alliance, the two giants in the industry have come in a position of tackling key technical hurdles while improving the trading experience for millions of consumers.

Whether you are a crypto exchange, a DeFi protocol, or an enterprise looking to leverage the potential of decentralized networks, Instanodes is your partner of choice for scalable, secure, and high-performance blockchain node infrastructure.

Ready to scale your blockchain operations with confidence? Partner with Instanodes — the top blockchain node provider for enterprises who expect the best.

by Admininsta | Apr 29, 2025 | Instanode |

The top blockchain node provider Instanodes has entered into a strategic alliance with global tech leader Huawei, and it’s a historic move towards transforming the blockchain market. This partnership represents a turning point in Web3 infrastructure development, joining two titans from formerly distinct technological spheres.

Instanodes, known most for its enterprise-grade blockchain node solutions, will now be combining with Huawei’s vast cloud computing infrastructure to deliver what industry leaders are referring to as a “new paradigm” for decentralized network design.

The collaboration will transform Web3 infrastructure by bringing Instanodes’ expert blockchain knowledge together with Huawei’s leading cloud computing abilities. We will be leveraging Huawei’s distributed data centers in Asia, Europe, and emerging markets, which will dramatically improve the performance, security, and reliability of blockchain nodes we set up for our customers.

The partnership is timely as conventional blockchains are increasingly struggling with scalability, energy efficiency, and congestion in networks. We are integrating our respective technological prowess, and we hope to develop a more efficient and sustainable foundation for decentralized applications of the next generation across finance, supply chain, healthcare, and more.

Let’s Get Introduced to Instanodes & Huawei

Instanodes has positioned itself as one of the most trusted blockchain node providers in the industry. We create robust and reliable node infrastructure for various blockchain networks, including EVM-compatible and non-EVM-compatible ones. Instanodes has been at the forefront of creating solutions that allow businesses and developers to interact with blockchain networks securely and efficiently. Our node management services have become critical for businesses wanting to construct and grow decentralized applications without the technical hassle of hosting blockchain infrastructure.

Huawei, the worldwide leader in telecommunication equipment and consumer electronics, has now established its brand in the business of cloud computing through Huawei Cloud. Even after encountering regulatory woes in some regions, Huawei has continued to make strides and increase its technological advances, especially in Asia, the Middle East, and Europe. The firm’s cutting-edge cloud infrastructure, combined with investments in future technologies such as AI and edge computing, makes it the perfect partner for handling the singular needs of decentralized networks.

Instanodes Leverages Huawei Cloud for Scalable and Secure Web3 Solutions

The collaboration will make it easier for Instanodes to host its blockchain nodes on Huawei Cloud infrastructure, utilizing Huawei’s worldwide data center network to improve the performance and reliability of blockchain services. We will use Huawei’s high-performance computing resources, advanced networking features, and security solutions to drive our node infrastructure.

As we will be using Huawei Cloud’s leading-edge infrastructure, we can provide our customers with unprecedented performance, availability, and security. As a blockchain node provider, the partnership is highly valuable as it allows us to extend our global reach and provide low-latency blockchain services to markets hitherto not well served by current node providers.

Huawei Cloud’s powerful infrastructure will allow us to promise greater uptime and quicker response times for blockchain activities. The collaboration also includes collaborative research and development projects aimed at streamlining cloud resources for blockchain-specific workloads, giving rise to breakthroughs in the deployment and administration of blockchain nodes.

Addressing the Core Challenges of Web3 Infrastructure

The partnership between one of the top blockchain node providers and Huawei specifically solves three long-standing issues that have impeded Web3 adoption: infrastructure stability, network congestion, and technical sophistication.

Blockchain networks need a strong and distributed infrastructure of nodes to ensure decentralization and security. But sustaining this infrastructure at scale has proven difficult. Network outages and performance degradation during peak usage have haunted numerous blockchain projects, eroding user trust and constraining enterprise adoption.

The alliance will create an even stronger and more responsive network of nodes by merging Instanodes’ blockchain expertise with Huawei’s cloud platform. Huawei’s global distributed data centers will reduce network latency and boost transaction throughput, and its advanced load balancing and auto-scaling will ensure smooth performance under heavy loads.

The collaboration also centers on demystifying the technical complexity that comes with blockchain integration. In combined development, Instanodes and Huawei are building standardized APIs and development tools that will facilitate it for businesses to integrate blockchain capabilities into their existing systems without specialized blockchain skills.

Scalability, Security, and Efficiency: Key Benefits of the Collaboration

The Instanodes-Huawei partnership aims to deliver several substantial advantages to the Web3 ecosystem, with scalability, security, and efficiency being the main focus areas.

From the perspective of scalability, the collaboration enables Instanodes to scale its node infrastructure rapidly to keep up with rising demand. Huawei Cloud’s elastic computing capabilities enable Instanodes to horizontally scale across various regions to ensure that blockchain networks can support growing transaction volumes without experiencing performance degradation. Such scalability is particularly crucial for enterprise use that requires consistent performance regardless of network conditions.

Security enhancements are yet another major part of the partnership. Huawei’s extensive experience in cybersecurity, added to Instanodes’ security measures tailored especially for blockchain, offers a multi-layered security approach. The partnership includes bringing advanced threat detection systems, hardware security modules for key management, and regular security audits to protect against emerging threats.

Efficiency will be gained through optimization of energy use and resource allocation. Blockchain networks have been criticized as having excessive energy usage, particularly Proof-of-Work-based networks. Instanodes and Huawei are jointly pursuing research studies for more efficient node operation methods with Huawei’s experience in green computing to reduce the environmental impact of blockchain infrastructure.

Empowering Developers with Cost-Effective, High-Performance Blockchain Infrastructure

One of the most important implications of this collaboration is the democratization of high-quality blockchain infrastructure. Historically, running trustworthy blockchain nodes involved a high degree of technical proficiency and financial means, excluding smaller business enterprises and individual developers.

Through this partnership, Instanodes will provide tiered service plans that bring enterprise-class blockchain infrastructure within reach of organizations of any size. Developers will be able to leverage detailed documentation, pre-configured templates, and managed services that abstract the complexity of node management.

Our mission is to simplify blockchain development as much as regular web development. By taking care of the infrastructure challenges, we allow developers to concentrate on creating creative applications instead of being concerned about node synchronization, network connectivity, or security concerns.

Final Thoughts

The strategic alliance between Instanodes and Huawei is a major milestone in the development of Web3 infrastructure. Being a well-known blockchain node provider, Instanodes has deep blockchain knowledge. The combination of our expertise and Huawei’s cloud computing strengths makes this partnership worthwhile. It’s a step forward to overcome the inherent limitations that have held back blockchain adoption and opens the door to more scalable, secure, and accessible decentralized applications.

What sets us apart from the rest of the blockchain node providers is our ability to set up and manage nodes for EVM-compatible and non-EVM-compatible nodes with an assurance of 99.9% uptime.

We make it easier for enterprises to explore blockchain solutions for various use cases, including supply chain management and decentralized finance, by offering reliable blockchain infrastructure that is monitored 24/7. The Instanodes-Huawei partnership provides a solid foundation upon which the next generation of Web3 applications can be built.

Get in touch with Instanodes today to explore our enhanced node services powered by Huawei Cloud. Build decentralized solutions of tomorrow with enterprise-grade reliability.

by Admininsta | Apr 14, 2025 | Instanode |

The blockchain market has witnessed immense growth in the last couple of years with more and more organizations and individuals viewing it as an ideal tool for secure, transparent, and decentralized transactions. Since the use of blockchain networks picked up speed, concerns about its scalability and expense of transactions increased. That’s where blockchain rollups can rescue the situation and prove to be a silver lining for this conundrum.

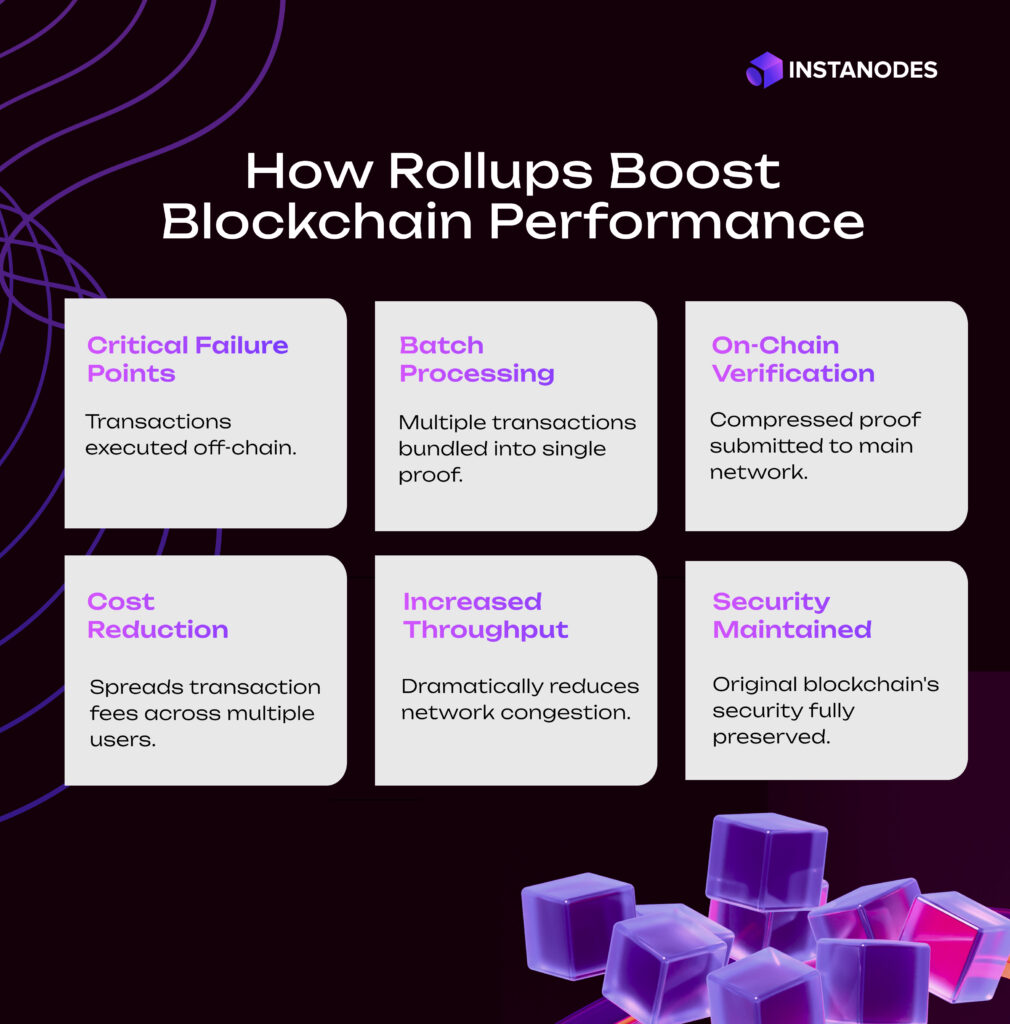

Rollups in blockchain enhance transaction throughput and reduce costs as they perform transaction execution off-chain and post only summary data on the main blockchain. Thus, businesses prefer building dApps using crypto rollups to enable faster and cheaper blockchain transactions.

Choosing the right Rollup as a Service is the easiest way of handling the hassles of building scalable infrastructure for decentralized applications. However, before doing that, one must be aware of the difference between crypto ZK rollups and Optimistic rollup, and how both these handle the aspects of transaction speed, cost, and scalability.

The Scalability Problem and the Promise of Blockchain Rollups

Although blockchain technology has completely changed the way we carry out financial transactions and maintain records without losing our confidentiality, we are bothered by its fundamental limitation known as the “blockchain trilemma.” This is a notion developed by Ethereum co-founder Vitalik Buterin that blockchain networks can only optimize two of three attractive properties: decentralization, security, and scalability. Most conventional blockchains such as Bitcoin and Ethereum sacrificed the third in favor of the first two.

The effects of poor scalability manifest in high fees and delayed processing. During their peak, like in the 2017 CryptoKitties incident or the 2020-2021 DeFi bubble, Ethereum’s gas fees mounted to insane amounts that easily charged more than $100 for a simple transaction. Bitcoin is also bound by similar limits, handling some 7 TPS, compared to Ethereum with 15-30 TPS. Central payment processors such as Visa, being centralized, support up to 65,000 TPS. This is where rollup crypto solutions are needed.

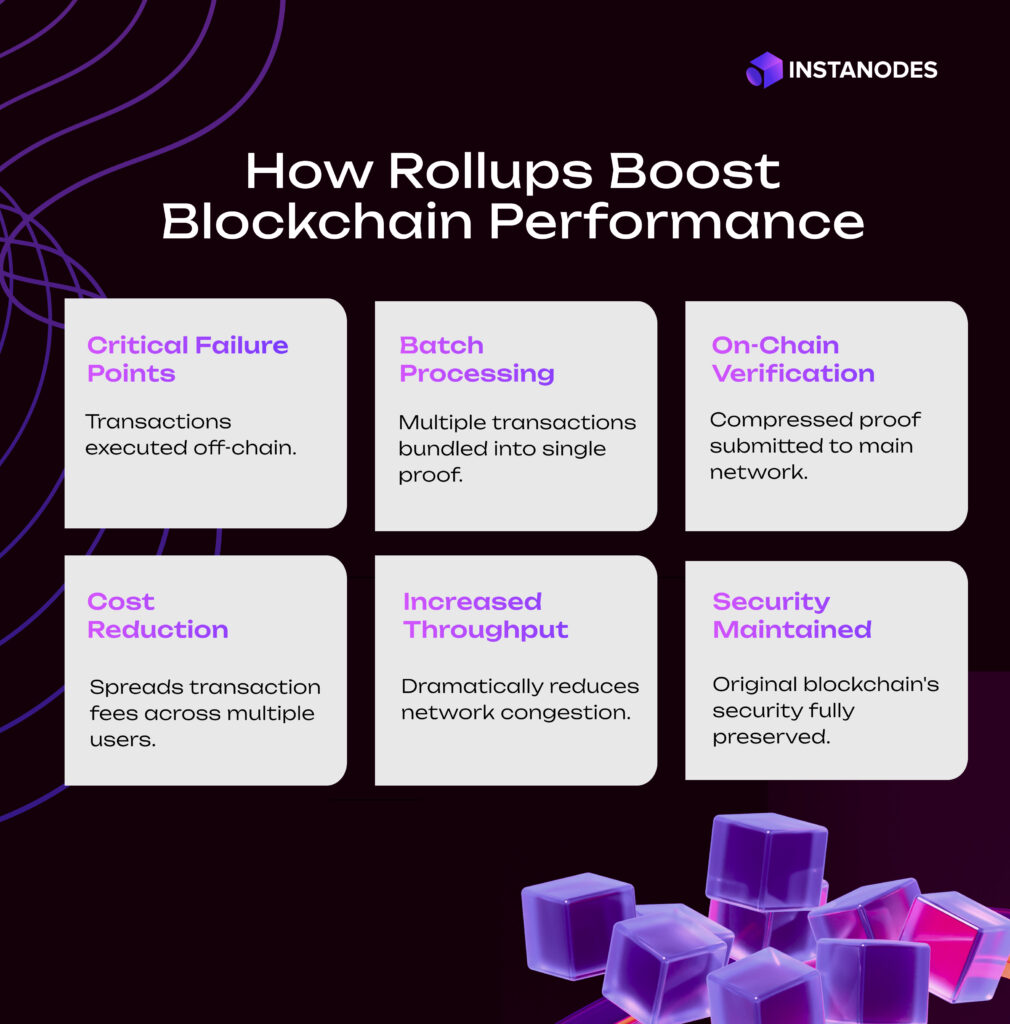

Rollup in crypto is a layer-2 scaling solution that performs transactions off the main chain while recording transaction information back on the main chain. By transferring computation off-chain but keeping security ensured through the main blockchain, rollups are able to hugely improve throughput and decrease costs.

The allure of blockchain rollups is strong as they have the potential to scale Ethereum and other networks to thousands of transactions per second and lower fees by orders of magnitude. Rollups can bring throughput up 10-100x over layer-1 processing alone, as per Ethereum’s documentation. This revolutionary potential has established rollups as a mainstay of Ethereum’s scaling plan and has piqued interest throughout the blockchain ecosystem.

Rollups Explained: Bundling Transactions for Off-Chain Execution

In essence, rollup in crypto is a sophisticated scaling architectural technique. Instead of validating every single transaction on the root blockchain (layer-1), rollups batch or “roll up” several hundred or several thousand transactions together. These batches are then processed off-chain on a separate layer (layer-2), with only the essential proof or data being submitted back to the main chain.

The mechanism works through several key components:

Users submit transactions to the rollup’s smart contract or operator.

These transactions are executed in a separate environment outside the main blockchain.

Multiple transactions are bundled together into a single data structure.

A cryptographic proof or data set that verifies the validity of all transactions in the batch is created.

This proof or compressed data is submitted to the main blockchain as a single transaction.

The main chain verifies the proof or accepts the data, ensuring that all bundled transactions are valid.

This workflow makes it possible to distribute the computational load effectively, because the complex processing is done off-chain while and the main chain just have to handle the verification. As a result, transaction throughput is increased manifold times and a significant reduction in fees also happens. The cost of a single main chain transaction is distributed across hundreds or thousands of rollup transactions.

From the user’s point of view, the transactions done using a rollup crypto solution are similar to that using the main blockchain directly. Users sign transactions with their private keys and submit them to the rollup network. The difference is in the backend processing and the substantially lower fees and faster confirmations that users experience.

A critical aspect of rollups is their inherent security model. Unlike some scaling solutions that operate independently, rollups derive their security from the main blockchain. By submitting transaction information or proofs on-chain, blockchain rollups guarantee that even when the rollup operators are malicious, users’ funds are safe, and the proper state can be restored from the on-chain information.

Ready to Scale with Custom Rollup Infrastructure?

Build, deploy, and manage secure and scalable rollups effortlessly with our Rollup as a Service platform.

Get Started Now

Optimistic Rollups vs. ZK Rollups: A Comparison of Validation Strategies

The rollup ecosystem has given rise to two predominant strategies, each characterized by specific features and trade-offs: Optimistic rollups and Zero-Knowledge rollups (crypto ZK rollups). Grasping the differences between these technologies is vital for both developers and users as they navigate the complexities of blockchain scaling.

| Becoming a Validator Node- Key Challenges and Solutions |

| Feature |

Optimistic Rollup |

ZK-Rollups |

| Validation Method |

Assumes transactions are valid unless challenged |

Uses zero-knowledge proofs for immediate validation |

| Challenge Mechanism |

Fraud proofs allow users to dispute invalid transactions |

No challenge period; validity proofs ensure correctness |

| Finality Time |

Longer (due to challenge period, usually ~7 days) |

Instant finality after proof submission |

| Gas Fees |

Lower than main chain but higher than ZK-Rollups |

Generally lower due to efficient proof mechanisms |

| Smart Contract Compatibility |

Supports all Ethereum smart contracts |

Limited compatibility, requires modifications |

| Security Model |

Relies on economic incentives and fraud detection |

Cryptographic security with mathematical proofs |

| Popular Projects |

Optimism, Arbitrum |

StarkNet, zkSync, Polygon zkEVM |

Optimistic Rollups

As the name reflects, Optimistic rollups operate under the assumption of optimism: transactions are regarded as valid by default unless there is proof to the contrary. This approach includes several fundamental steps.

- Transactions are processed off-chain by sequencers (specialized nodes).

- The results are posted to the main chain without immediate verification.

- A challenge period (typically 7 days) follows, during which anyone can submit a “fraud proof” if they detect an invalid transaction.

- If a “fraud proof” is successfully verified, the invalid batch is rolled back and replaced with the correct one.

Key examples of optimistic rollup implementations include Optimism and Arbitrum. These platforms have experienced remarkable growth, with Optimism rollups executing millions of transactions and hosting a diverse range of decentralized applications.

The advantages of Optimistic rollups include:

- Relatively simple implementation

- EVM compatibility, making it easy to port existing Ethereum applications

- Lower computational requirements for participants

However, Optimistic rollups also have limitations:

- Long withdrawal periods (typically 7 days) due to the challenge window

- Reliance on at least one honest participant to identify fraud

- Additional complexity in handling dispute resolution

ZK-Rollups

Zero-Knowledge rollups take a fundamentally different approach to validation. Instead of assuming transactions are valid and waiting for challenges, crypto ZK rollups use advanced cryptography to mathematically prove the validity of each batch:

- Transactions are processed off-chain.

- A cryptographic argument referred to as a ZK-SNARK (Zero-Knowledge Succinct Non-Interactive Argument of Knowledge) or ZK-STARK is created.

- It checks that every transaction in the batch is legitimate without showing the underlying transaction data.

- The proof is posted to the main chain and verified through a relatively simple computation.

Major ZK-rollup initiatives are zkSync, StarkNet, and Polygon’s zkEVM. Crypto ZK rollups have worked exceptionally well for particular applications such as token swaps and transfers.

The advantages of ZK-rollups include:

- Near-immediate finality once the proof is verified on-chain

- Stronger privacy guarantees due to the zero-knowledge property

- Potentially greater data compression, leading to lower costs

However, ZK-rollups also face challenges:

- Higher computational requirements for generating proofs

- More complex implementation, particularly for general-purpose computation

- Historical limitations in EVM compatibility (though recent advances are addressing this)

The choice between optimistic and ZK approaches involves trade-offs between implementation complexity, withdrawal times, computational requirements, and compatibility with existing infrastructure. Optimistic rollups currently lead in EVM compatibility and developer adoption, while crypto ZK rollup offer advantages in finality time and potential for privacy.

As rollup technology matures, we’re seeing a convergence where both approaches are adopting each other’s strengths. Optimistic rollups are working to reduce challenge periods, while ZK-rollups are improving their EVM compatibility and reducing proof generation costs.

How Rollups Enhance Throughput and Reduce Gas Fees

Rollups in blockchain impacts performance dramatically and benefit users by addressing two of the most significant pain points: transaction throughput and gas fees. This improvement stems from the fundamental architectural change that rollups introduce to transaction processing.

Enhanced Transaction Throughput

Conventional blockchain networks handle all the transactions on the base chain with every node on the network performing the same action. This redundancy ensures security but severely limits throughput. Rollups dramatically increase capacity through several mechanisms:

While the main chain continues its normal operation, rollups process transactions in parallel, effectively adding a new processing lane to the blockchain highway.

By bundling hundreds or thousands of transactions into a single batch, rollups achieve economies of scale in processing.

Rollup operators can optimize their execution environments specifically for transaction processing, without the overhead of maintaining a full consensus mechanism.

The numbers speak for themselves. While Ethereum’s layer-1 manages approximately 15-30 TPS, rollup solutions can theoretically process thousands of transactions per second. Optimism rollups and other implementations have demonstrated throughput improvements of 10-100x compared to base layer processing. As rollup technology matures and implements further optimizations, these numbers are expected to increase even further.

Substantial Fee Reduction

The high gas fees on networks like Ethereum have been a significant barrier to adoption. Rollups address this issue directly:

The cost of a single layer-1 transaction is spread across all the transactions in a rollup batch. If a batch contains 1,000 transactions, each user might pay just 1/1000th of the base layer fee.

Rollups use numerous compression mechanisms to lower the quantity of data committed to the main chain, which means an additional reduction in costs.

- Competition Among Rollups

With numerous competing crypto rollups solutions, they gain incentives to optimize for lower fees and improved performance.

In practice, rollups have achieved remarkable fee reductions. Transactions on optimistic rollup chains such as Arbitrum and Optimism usually cost 3-10 times less than similar transactions on Ethereum’s base layer. Crypto ZK rollups have proven even more efficient in some instances, with fees cut by factors of 10-100x for specific operations.

Real-World Impact

The throughput enhancement and fee reduction provided by rollups have real-world implications for blockchain applications:

With significantly lower fees, use cases involving small payments become economically viable.

Faster confirmations and reduced costs provide a more seamless experience for end users.

- New Application Categories

The enhanced performance supports new classes of applications that would be infeasible on busy base layers, including gaming, social media, and high-frequency trading.

Reduced costs bring blockchain applications within reach of users in regions with lower purchasing power.

As businesses are increasingly becoming adaptive to blockchain technology, the role of Rollup as a Service has become significant, as it allows developers to leverage scaling benefits without facing the intricacies of building and maintaining a rollup infrastructure on their own.

Data Availability: Ensuring Security and Trustworthiness in Rollup Networks

Availability of data is a critical aspect of crypto rollups security. It’s necessary to ensure that the data required for transaction validation and reconstruction of the state is accessible to all network participants. It’s a most basic consideration for maintaining the guarantee of security that is expected by the users while using the blockchain systems.

The Data Availability Challenge

In rollup architectures, a key question emerges: how much data should be posted on-chain versus kept off-chain? This question leads to different approaches:

All transaction data is posted on the main chain, ensuring that anyone can verify and reconstruct the rollup state independently.

- Partial Data Availability

Only compressed transaction data or validity proofs are posted on-chain, with full data stored elsewhere.

The choice between these approaches involves trade-offs between cost, security, and decentralization. Posting all data on-chain maximizes security but increases costs. Keeping data off-chain reduces costs but potentially introduces new trust assumptions.

ZK-Rollups and Data Availability

ZK rollups have a unique advantage in the data availability landscape. Because they post cryptographic proofs that mathematically verify transaction validity, they can potentially store less data on-chain while maintaining security. This approach:

- Allows for greater compression of on-chain data

- Maintains verifiability through the zero-knowledge proofs

- Can reduce costs while preserving security guarantees

However, even ZK rollups must consider data availability carefully. Without access to the underlying transaction data, certain types of dispute resolution become impossible, and the ability to exit the rollup during emergencies may be compromised.

Optimistic Rollups and Data Availability

Optimistic rollups face a more direct data availability requirement. Because their security model relies on fraud proofs—where observers can challenge invalid state transitions—transaction data must be available for verification. This typically means:

- Posting sufficient data on-chain to enable fraud proofs

- Ensuring challengers can access the information needed to detect fraud

- Maintaining data availability throughout the challenge period

Optimistic rollup projects like Optimism and Arbitrum have developed sophisticated approaches to balance data availability with cost-efficiency, including data compression techniques and optimized encoding methods.

Emerging Solutions

The blockchain ecosystem is developing novel solutions to the data availability challenge:

- Data Availability Committees (DACs)

Trusted groups responsible for storing and attesting to data availability.

- Data Availability Sampling (DAS)

A technique where nodes verify data availability by sampling random chunks of data.

- Dedicated Data Availability Layers

Specialized blockchains or protocols focused specifically on storing and verifying data availability.

Combinations of on-chain and off-chain data with various trust models and verification mechanisms.

These approaches aim to provide the security guarantees of full on-chain data availability with the cost efficiencies of off-chain storage.

Boost Your Network’s Speed And Reduce Costs

Integrate blockchain rollups for seamless scalability now!

Get Started Now

How Instanodes Provides Scalable Infrastructure to Businesses

With the growing awareness about blockchain rollups among businesses and individuals, the need to find experts for building a reliable infrastructure has become highly important. In this scenario, Instanodes has become a key provider of Rollup as a Service, and offers specialized infrastructure tailored to the unique requirements of blockchain based ventures.

Infrastructure Challenges for Rollup Networks

Rollup networks present distinct infrastructure requirements compared to traditional blockchain nodes:

Reliable infrastructure for transaction ordering and batch creation

Computational resources for creating validity proofs (for crypto ZK rollup)

Systems for verifying transaction data and processing state transitions

- Cross-Layer Communication

Infrastructure for handling communication between layer-1 and layer-2

These requirements demand specialized knowledge and infrastructure optimization that many businesses lack internally.

Instanodes’ Comprehensive Rollup Infrastructure

Instanodes addresses these challenges by providing end-to-end infrastructure solutions for businesses leveraging rollup technology:

Optimized infrastructure for dedicated rollup deployments, such as Optimism rollups, Arbitrum, and crypto ZK rollups solutions.

- Rollup as a Service (RaaS)

Managed services that deal with the intricacies of rollup deployment, execution, and upkeep so that businesses can concentrate on their core applications.

- High-Performance Computing

Specialized hardware configurations designed for efficient proof generation and transaction processing.

Enterprise-grade infrastructure with redundancy and monitoring to ensure continuous operation of critical rollup components.

Infrastructure that facilitates seamless interaction between different blockchain layers and networks.

Business Benefits of Specialized Rollup Infrastructure

By leveraging Instanodes’ infrastructure, businesses can realize several key advantages:

- Reduced Operational Complexity

Offloading technical rollup infrastructure complexity to experts enables development teams to concentrate on creating applications instead of running infrastructure.

Shared infrastructure and scale economics lower the expense of deploying and running rollup solutions in comparison to creating in-house capabilities.

Pre-configured rollup infrastructure facilitates faster application deployment, shortening time-to-market for blockchain products.

Cloud infrastructure that scales with usage patterns to support growth without the need for ongoing reconfiguration.

Specialized expertise access for troubleshooting and optimizing rollup implementations.

Conclusion

Rollups in blockchain are one of the most promising methods for overcoming the long-standing scalability issues that have hindered more extensive blockchain deployment. By decoupling computation from the blockchain, while preserving security via the root blockchain, blockchain rollups present an attractive solution without compromising the basic advantages of blockchain technology.

There are two main crypto rollup flavors—optimistic and ZK—each offer different solutions to the validation problem with their respective strengths. Optimistic rollups are simple and backwards-compatible with current smart contracts but have longer withdrawal times. Crypto ZK rollup have quicker finality and confidentiality advantages but use more complicated cryptography. Both solutions are constantly changing quickly, with research ongoing into addressing their respective weaknesses.

The advantages of rollup in crypto are enormous and profound. In dramatically scaling transaction throughput and diminishing fees, rollups make blockchain technology feasible.

by Admininsta | Apr 8, 2025 | Instanode |

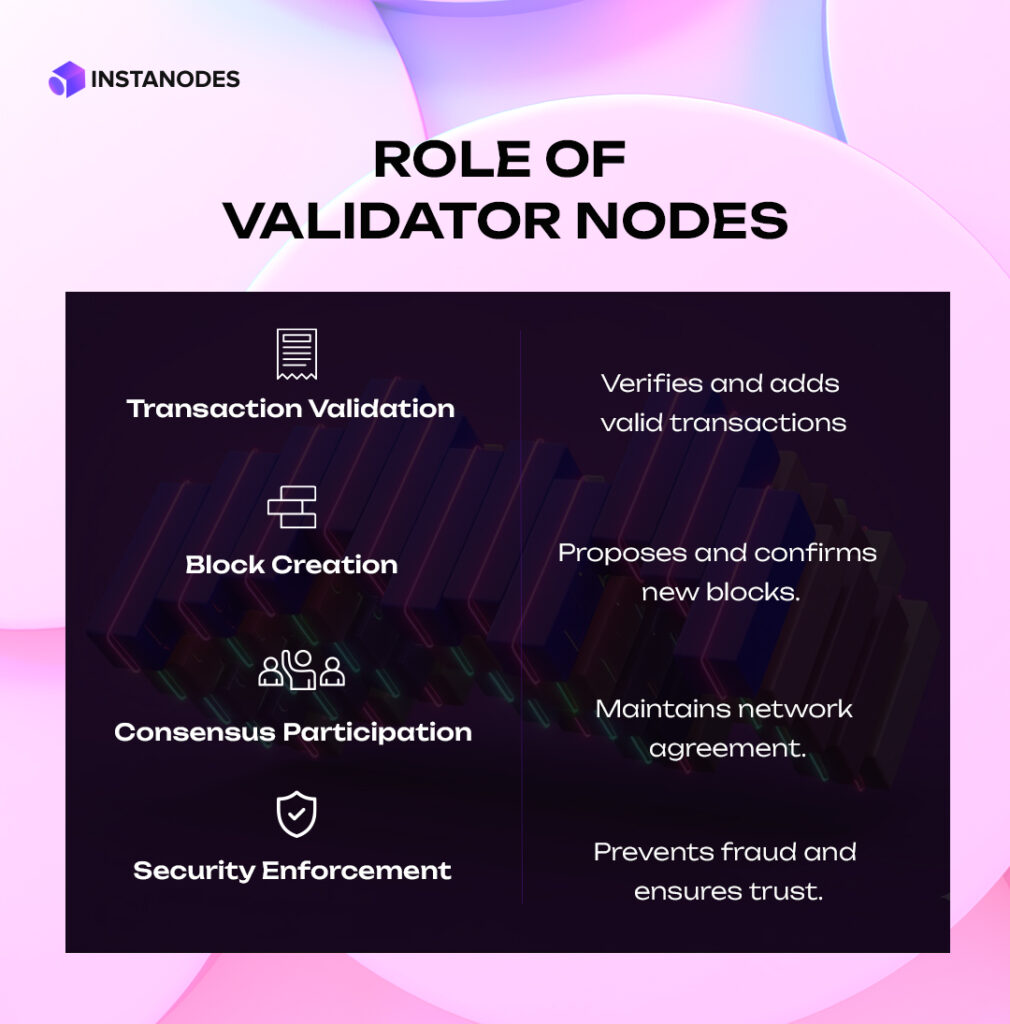

Ever wonder how blockchain networks stay secure and reliable? The unsung heroes are Validator Nodes!

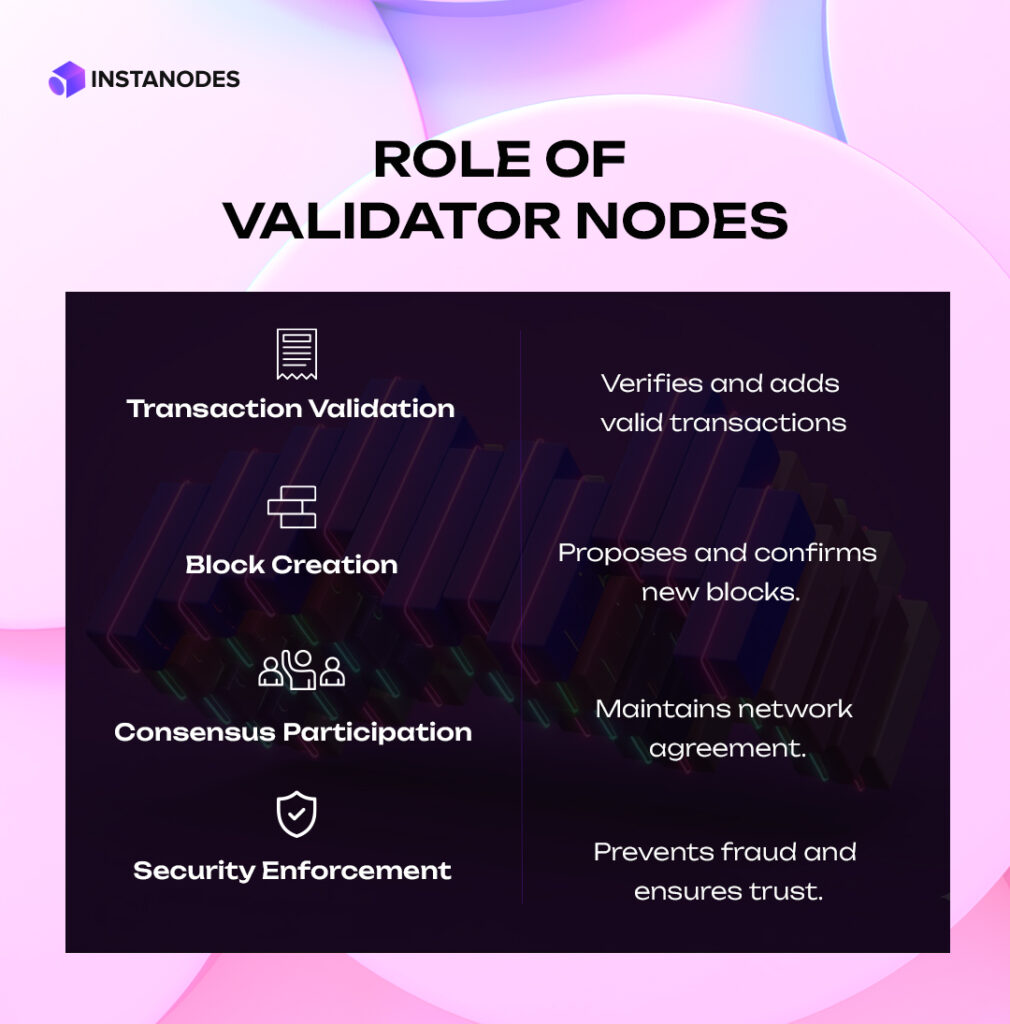

Crypto validator Nodes form the backbone of a blockchain network, as they play actively participate in the validation of transactions, creation of new blocks, and protect the integrity of the blockchain. They are most involved in governance and decentralization, keeping the network efficient and well-functioning. A Validator Node is the guardian of the well-being and security of the system.

Yes, it can be daunting but ultimately rewarding work. It requires technical expertise, specialized hardware, and enthusiasm for the success of the network. However, the reward is real: getting involved in consensus mechanisms, receiving rewards, and helping determine the future of decentralized tech.

Are you curious about becoming a validator? First, you must get a clear understanding of active validator services, the criteria of validator selection, the challenges of becoming a validator, and the right way of dealing with those intricacies.

What are Validator Nodes?

Validator nodes are specially designated participants on blockchain networks using Proof of Stake (PoS) or analogous consensus algorithms. Unlike miners on Proof of Work networks competing to solve intricate math problems, Proof of Stake validators are chosen to generate new blocks and validate transactions based on the quantity of cryptocurrency they’ve put up as collateral—a process called staking.

At their most basic form, these crypto validator nodes are machines operating blockchain software that are set up to engage in the process of consensus. Their hardware is usually specialized machines that have particular requirements in terms of processing power, memory, and storage space.

For example, an Ethereum validator has to hold 32 ETH as a stake and operate validator client software on a machine that has minimum hardware requirements. They get paid for their role in maintaining the blockchain’s integrity. It is also a simple way of ensuring passive income crypto staking. However, it will be necessary to understand how to run a validator node on Ethereum before taking a step toward becoming a validator.

Basically, Validator Nodes play the role of autonomous auditors, ensuring transactions’ authenticity and legitimacy before being incorporated in the blockchain. As transactions are packaged into blocks, validators cross-check them to ensure they’re valid, going through signatures, account balances, and other variables set by the protocol of the blockchain. On being validated, the blocks get appended to the blockchain, with a permanent, unalterable record of the transactions.

What sets validator nodes apart from normal full nodes is their active engagement in block production and their economic interest in the network’s prosperity. This economic incentive provides validators with a strong motivation to behave well since malicious activity threatens the loss of their staked funds through a penalty system called slashing.

Launch Your Validator Node

Launch your validator node and earn passive rewards while strengthening blockchain security!

Get Started Now

Core Functions: Transaction Validation and Block Creation

The operational heart of a validator node revolves around two primary functions: validating transactions and creating new blocks.

Transaction Validation

When users make transactions on a blockchain network, they are placed in a mempool—a queue for unconfirmed transactions. Validator nodes extract transactions from the pool and execute a series of checks to validate their legitimacy:

- Signature Verification: Verifying that the owner of the sending address with the proper private key actually signed the transaction.

- Balance Verification: Ensuring that the sender holds enough funds to carry out the transaction.

- Nonce Checking: Verifying that the transaction sequence number is correct to prevent double-spending.

- Gas/Fee Assessment: Determining if the transaction includes adequate fees to process it (especially relevant on networks like Ethereum).

- Smart Contract Execution: For transactions involving smart contracts, validators must execute the contract code to verify its outcome.

The verification process acts as the initial line of protection against malicious use, stopping double-spending attacks and unauthorized transactions from being processed on the blockchain.

Block Creation

After validating transactions, crypto validator nodes bundle them into blocks according to the network’s specifications. The block creation process typically involves:

- Transaction Selection: Choosing which valid transactions from the mempool to include, often prioritizing those with higher fees.

- Block Assembly: Structuring the selected transactions into a block format that includes a reference to the previous block (creating the “chain”).

- Timestamp Application: Adding a timestamp to mark when the block was created.

- Block Proposal: Submitting the newly created block to the network for confirmation by other validators.

Ethereum employs a PoS consensus algorithm, and a Ethereum validator is chosen randomly to create new blocks using a process referred to as the beacon chain. Upon selection, a validator is tasked with creating a block in a time slot, which usually takes around 12 seconds. Missing a block creation when selected may incur penalties, decreasing the validator’s staked ETH.

The two-fold duties of transaction verification and block generation make validator nodes the central guardians of blockchain integrity, where only valid transactions are added to the permanent record.

Consensus Mechanisms: The Heart of Validator Operations

Consensus protocols are the philosophical and technical foundation of how validator nodes communicate and come to an agreement on the state of the blockchain. These protocols dictate how decisions are reached in a decentralized system where there is no central authority.

Proof of Stake (PoS)

In Proof of Stake systems, validators are chosen to build blocks proportionally to their economic stake in the network. This method minimizes the energy usage of Proof of Work mining while ensuring security through economic incentives.

Ethereum’s version of PoS, Casper, works by using its beacon chain to coordinate validators and handle the staking. Validators stake 32 ETH to take part in block creation and are rewarded for good behavior.

The key aspects of PoS consensus include:

- Economic Security: Validators must risk their own assets, creating a financial disincentive for malicious behavior.

- Energy Efficiency: Without competitive mining, energy consumption is drastically reduced compared to Proof of Work systems.

- Scalability Potential: PoS systems are capable of processing more transactions per second compared to their PoW counterparts.

Delegated Proof of Stake (DPoS)

Some blockchains such as EOS and Tron use Delegated Proof of Stake, in which token holders vote for a few validators (usually referred to as delegates or block producers) to lock up the network on their behalf. This method further centralizes validation duties but may enhance transaction throughput.

Practical Byzantine Fault Tolerance (PBFT)

Cosmos and Hyperledger Fabric blockchain networks employ derivatives of Byzantine Fault Tolerance protocols, which aim at building consensus even if there are malicious validators or failure cases. These systems most often need crypto validator nodes to exchange information heavily before completing the blocks, generating robust finality guarantees but possibly constraining scalability.

The consensus protocol used largely determines the behavior of validator nodes, their requirements in terms of resources, and the security features of the blockchain.

For example, an Ethereum validator needs to run several client software components in order to engage with its PoS consensus, whereas validators on other networks might need different technical prerequisites depending on their respective consensus protocols.

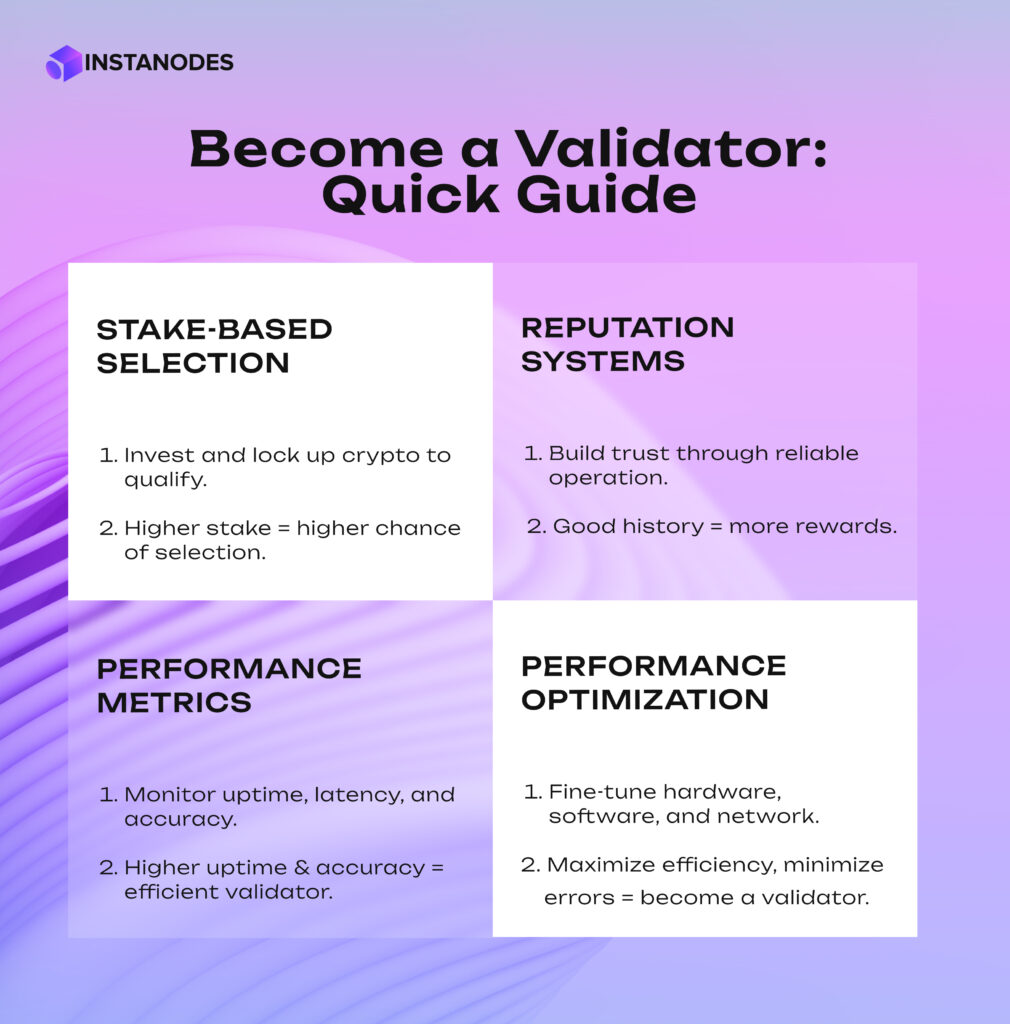

Validator Selection and Performance Monitoring

Making the selection of validators that will take part in consensus and observing their performance is of great significance as it ensures network health and security.

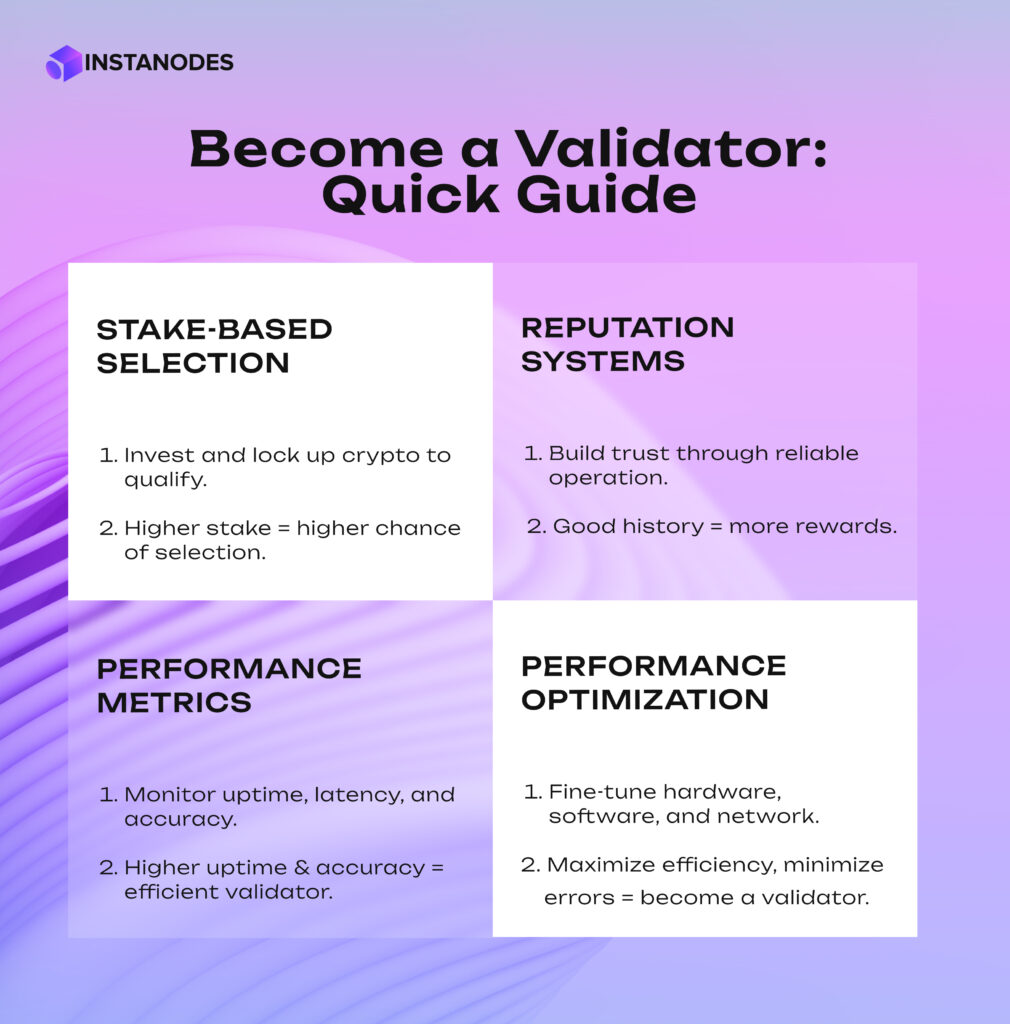

Selection Criteria

Different blockchains employ various approaches to validator selection:

- Stake-Based Selection: On Ethereum and similar networks, validators with a sufficient stake (e.g., 32 ETH) can activate validator status, though they may enter a queue before becoming active.

- Reputation Systems: Some networks incorporate historical performance metrics into selection probability, favoring validators with proven reliability.

- Random Selection: Within the pool of eligible validators, many systems use verifiable random functions to select block proposers, ensuring unpredictability and fairness.

For Ethereum specifically, the beacon chain manages validator activation, maintains a queue system when many validators attempt to join simultaneously, and handles the random selection process for block proposal and attestation duties.

Performance Metrics

Once active, validator nodes are continuously monitored across several key performance indicators:

- Uptime: The percentage of time a validator is online and responsive.

- Attestation Rate: How consistently the validator participates in voting on proposed blocks.

- Block Proposal Success: Whether the validator produces valid blocks when selected to do so.

- Slashing Events: Any instances of protocol violations that resulted in penalties.

These metrics not only influence rewards but also the validator’s reputation on the network. On Ethereum, the beacon chain monitors these figures using a scoring system that influences the validator’s eligibility for rewards and can activate penalties for bad performance.

Performance Optimization

Running a successful validator node requires ongoing optimization efforts:

- Hardware Scaling: Ensuring sufficient computing resources as network demands grow.

- Client Diversity: Using different client implementations to reduce systemic risks.

- Network Connectivity: Providing stable, low-latency internet connections.

- Monitoring Tools: Implementing alert systems to detect and respond to issues promptly.

Professional validation operations will frequently utilize high-level monitoring dashboards, dual systems, and fail-over procedures to ensure highest possible performance with the least possible downtime.

Start Validating Transactions!

We’ll set up your node and help secure the blockchain ecosystem.

Consult With Us

Security Measures: Protecting the Blockchain Network

Validators serve as primary security enforcers in blockchain networks, implementing multiple layers of protection against various attack vectors.

Slashing Mechanisms

Perhaps the most powerful security feature in PoS systems is slashing—the partial or complete forfeiture of staked assets for rule violations.

Actions that typically trigger slashing include:

- Double Signing: Producing two different blocks for the same slot.

- Equivocation: Voting for competing chains simultaneously.

- Long-Range Attacks: Attempting to rewrite blockchain history from a distant point.

For an Ethereum validator, slashing penalties can range from minor reductions for being offline to losing the entire 32 ETH stake for serious violations like intentional double-signing. This economic deterrent significantly raises the cost of attacking the network.

Security Against Common Attacks

Validator nodes implement specialized protections against known attack vectors:

- Sybil Resistance: The staking requirement prevents attackers from creating numerous fake identities to gain control.

- 51% Attack Prevention: The economic cost of acquiring 51% of staked assets makes such attacks prohibitively expensive.

- Long-Range Attacks: Social consensus and weak subjectivity checks prevent validators from rewriting ancient history.

- Nothing-at-Stake Problem: Slashing penalties solve the theoretical issue where validators might vote for multiple competing chains without consequence.

Network-Level Security

Beyond individual validator security, the collective behavior of crypto validator nodes provides network-level protections:

- Decentralization: A diverse, geographically distributed set of validators increases resilience against regional failures or regulatory actions.

- Client Diversity: Using multiple software implementations prevents single points of failure in the code.

- Attestation Committees: Many networks require multiple validators to attest to block validity, creating redundant verification.

The combination of economic incentives, technical safeguards, and coordination mechanisms enables validator nodes to maintain blockchain security even in adversarial environments where some participants may attempt to subvert the rules.

Governance and Decision-Making: The Influence of Validator Nodes

Validator nodes play a pivotal role in blockchain governance—the processes by which networks evolve and adapt over time.

On-Chain Governance

Many modern blockchains incorporate formal governance mechanisms where validators vote on protocol changes:

- Proposal Systems: Stakeholders (often including validators) can submit improvement proposals.

- Voting Mechanisms: Validators participate in voting, usually weighted by stake size.

- Implementation Thresholds: Proposals require specific approval percentages to be adopted.

Popular platforms such as Cosmos, Polkadot, and Tezos have advanced on-chain governance where validators are at the center of decision-making.

For instance, Tezos validators (“bakers”) vote on protocol changes in periodic upgrade cycles.

Ethereum Governance

Ethereum takes a more hybrid approach, using off-chain social consensus combined with on-chain execution:

- Ethereum Improvement Proposals (EIPs): Proposals for changes are made, debated, and shaped through an open process.

- Client Implementation: Multiple development teams incorporate accepted changes into their software.

- Validator Adoption: Validators choose whether to update their nodes to support new protocol versions.

While Ethereum doesn’t have formal on-chain voting, validators exercise considerable influence through their choice of which software clients and versions to run. Major upgrades require broad validator support to succeed.

Governance Responsibilities

Validators shoulder significant responsibilities in governance processes:

- Informed Participation: Staying educated about proposed changes and their implications.

- Community Representation: Often representing the interests of delegators or community members.

- Technical Evaluation: Assessing the security and performance impacts of upgrades.

- Signaling Support: Demonstrating commitment to changes through public statements or test network participation.

The concentration of stake among validators can sometimes raise concerns about plutocracy—rule by the wealthy—in governance decisions. To counter this, many projects implement mechanisms to ensure broader community input beyond just validator voting power.

Staking and Incentives: Why Validators Play a Crucial Role

The economic model behind validator operations is critical to comprehend their incentives and actions in blockchain systems.

Staking Requirements

Different networks set varying thresholds for validator participation:

- Ethereum: Requires exactly 32 ETH per validator node.

- Cosmos: The minimum stake varies by blockchain in the ecosystem.

- Polkadot: Utilizes a dynamic nomination scheme that chooses validators by total stake.

These criteria impose entry barriers that ensure validator nodes have substantial skin in the game while avoiding undue centralization.

Reward Mechanisms

Validators earn rewards through several mechanisms:

- Block Rewards: New tokens are issued when validators create blocks.

- Transaction Fees: A portion of fees paid by users for transactions.

- Attestation Rewards: Payments for participating in consensus by voting on blocks.

On Ethereum, validators currently earn approximately 3-5% APR on their staked ETH through a combination of these reward types. The exact percentage fluctuates based on the total number of active validators—more validators means the rewards are split among more participants.

Passive Income Through Staking

For many participants, validator operation represents an attractive passive income opportunity:

- Consistent Returns: Unlike volatile trading, staking provides relatively stable yields.

- Compound Growth: Rewards can be automatically restaked to increase future earnings.

- Network Participation: Stakers contribute directly to network security while earning.

The increasing popularity of “passive income crypto staking” has driven growth in both direct validator participation and delegated staking services, where users pool their assets with professional validators.

Delegation and Staking Services

Not everyone has the technical skills or minimum stake required to run a validator node.

Staking services bridge this gap:

- Pooled Staking: Services like Lido and Rocket Pool allow participation with less than 32 ETH.

- Exchange Staking: Platforms like Coinbase and Binance offer simplified staking for retail users.

- Professional Operations: Some entities specialize in running “active validator services” for institutional clients.

These services typically charge a percentage of staking rewards (usually 5-15%) in exchange for handling the technical complexities of validator operation.

How to Run a Validator Node on Ethereum

For those interested in operating their own Ethereum validator, the process involves several key steps:

Hardware Requirements

Successful Ethereum validators need appropriately specified hardware:

- Processor: Modern CPU with 4+ cores (Intel i5/i7 or AMD Ryzen)

- Memory: Minimum 16GB RAM, with 32GB recommended

- Storage: At least 2TB SSD storage for the blockchain data

- Network: Reliable broadband with a minimum of 10 Mbps upload/download speeds

- Power: Uninterrupted power supply to prevent downtime

While these requirements aren’t extreme, they exceed typical home computer specifications, particularly regarding storage and reliability needs.

Software Setup

The software stack for an Ethereum validator includes:

- Execution Client: Software that handles transaction processing (e.g., Geth, Nethermind, Besu)

- Consensus Client: Software that coordinates validation (e.g., Prysm, Lighthouse, Teku, Nimbus)

- Validator Client: Software that manages staking keys and signing duties

- Monitoring Tools: Solutions for tracking performance and receiving alerts

Client diversity is strongly encouraged, as running different client combinations helps protect the network against bugs in any single implementation.

Staking Process

The actual staking procedure involves:

- Generate Keys: Create validator keys using the deposit CLI tool.

- Fund Deposit Contract: Send 32 ETH to the Ethereum staking contract.

- Configure Clients: Set up and synchronize both execution and consensus clients.

- Activate Validator: Import validator keys and wait for activation (currently takes several days due to the activation queue).

- Monitor Performance: Once active, continuously monitor validator performance and maintain uptime.

The entire process requires considerable technical knowledge, especially for secure key management and ongoing maintenance.

Costs and Return Calculations

Running an Ethereum validator involves both upfront and ongoing costs:

- Staking Amount: 32 ETH per validator (approximately $50,000-$100,000 depending on market conditions)

- Hardware Costs: The cost of having a dedicated validator setup varies for different regions.

- Electricity: Depends on local rates

- Internet: Reliable broadband connection

Against these costs, validators can expect rewards of approximately 3-5% annually on their staked ETH. For a single validator with 32 ETH, this translates to roughly 1-1.6 ETH per year in current conditions.

Challenges Faced by Validator Nodes and Resolution

Validator nodes form the backbone of modern Proof of Stake blockchains, but operating them successfully involves navigating numerous technical, economic, and regulatory challenges. Understanding these obstacles and their potential solutions is crucial for maintaining network health and validator profitability.

| Becoming a Validator Node- Key Challenges and Solutions |

| Challenge |

Description |

Solutions |

| Hardware Failures |

Physical equipment malfunctions causing missed attestations and rewards |

- Implement redundant systems with automatic failover

- Use enterprise-grade hardware with extended warranties

- Deploy monitoring systems with immediate alerts

|

| Network Connectivity Issues |

Unstable internet connections leading to reduced validator performance |

- Utilize multiple ISP connections with automatic switching

- Deploy validators across different geographic locations

- Implement BGP routing for enterprise setups

|

| Client Software Bugs |

Software errors that can cause slashing or missed rewards |

- Run multiple client implementations simultaneously

- Participate in testnet deployments before mainnet upgrades

- Maintain separate test environments for updates

|

| Security Vulnerabilities |

Potential for key theft or unauthorized access |

- Use hardware security modules for key storage

- Implement strict network segregation policies

- Deploy intrusion detection systems

- Conduct regular security audits

|

| Regulatory Uncertainty |

Unclear legal status of staking operations in many jurisdictions |

- Maintain transparent operations and documentation

- Engage with regulatory organizations proactively

- Participate in industry self-regulation initiatives

- Consider legal domiciling in crypto-friendly jurisdictions.

|

| Centralization Pressures |

Economic incentives favoring large-scale operations |

- Support client diversity initiatives

- Participate in decentralized staking pools

- Advocate for protocol changes that favor decentralization

|

| MEV Extraction Ethics |

Moral and economic questions around extractable value |

- Adopt transparent MEV policies

- Support fair MEV distribution protocols like MEV-Boost

- Contribute to research on equitable MEV solutions

|

| Liquidity Constraints |

Locked capital during staking periods limiting flexibility |

- Utilize liquid staking derivatives where appropriate

- Develop balanced portfolios with staked and liquid assets

- Implement careful risk management strategies

|

| Slashing Risks |

Potential for penalties due to double signing or other violations |

- Run slashing protection databases

- Implement proper key management procedures

- Avoid running the same validator keys in multiple locations.

|

| Economic Sustainability |

Fluctuating rewards and increasing competition |

- Optimize operations to reduce costs

- Diversify across multiple networks.

- Offer value-added services beyond basic validation.

|

How Instanodes Helps to Set Up Validator Node

Instanodes simplifies validator node setup through:

- Automated deployment with pre-configured templates that eliminate complex manual installations

- Intuitive dashboard for monitoring node performance, rewards, and network status

- One-click updates when protocol changes occur, ensuring validators stay current

- Built-in security features including automatic firewall configuration and key management

- Technical support from blockchain specialists who assist with troubleshooting

- Multi-chain support enabling validators to diversify across various networks

- Provides pre-synchronized nodes, significantly reducing the initial syncing time which can take days or even weeks.

- Intelligent scaling that automatically adjusts resources based on network demands

- Cost optimization through cloud resource management that reduces unnecessary expenses

- Backup/recovery systems protecting against data loss or corruption

- Educational resources guiding users through validator requirements and responsibilities

Conclusion

Validator nodes form the backbone of blockchain security and governance. They foster decentralization and innovation through secure transaction validation, network integrity preservation, and contribution to governance.

With increasing active validator services, crypto validator nodes, and passive income crypto staking, the blockchain technology will remain secure.

Want to become an Ethereum node, or simply curious to understand how to run a validator node on Ethereum before making an investment? Consult Instanodes!

We create and maintain nodes for you, making your networks decentralized, secure, and efficient. Don’t hesitate, let’s have open discussions.

by Admininsta | Mar 31, 2025 | Instanode |

Blockchain technology has experienced an amazing journey since it emerged as the basis of technology behind Bitcoin. All the initial L1 blockchains such as Bitcoin and Ethereum existed as the bottom layer, and all transactions and smart contracts were directly managed by them.

Yet, when adoption of blockchain increased, L1s also became scalability-inclined and their transaction charges soared high with low processing times. This paved the way for Layer 2 (L2) solutions such as Lightning Network and rollups that work over L1s to execute transactions off-chain in order to improve throughput and cut down expenses.

Later, more innovation caused the development of Layer 3 (L3) solutions that concentrated on a particular functionality such as data storage or identity management, typically implemented on top of L2s or even L1s. These layers establish a more efficient and modular blockchain ecosystem.

The concept of AppChains emerged with Cosmos SDK (2019), enabling independent, customizable blockchains

Currently, the concept of Appchain, or Application Specific Blockchain have attracted more attention in recent times. In contrast to general-purpose L1s, AppChains are application-specific blockchains for a single use case or a limited number of related use cases. Developers can then design the blockchain for their specific dApp needs, providing more control over performance, security, and governance. This shift away from monolithic L1s to a more complex multi-layered and appchain-based architecture is the result of the ever-present search for scalability, efficiency, and customization in the blockchain world.

| Layer 1 vs. Appchains: A Detailed Comparison |

| Aspect |

Layer 1 dApps |

Appchains |

| Definition |

Independent, foundational blockchain. |

Standalone blockchain optimized for a specific application. |

| History & Evolution |

Layer 1 blockchains like Bitcoin and Ethereum have evolved as the foundation of decentralized networks. |

Appchains emerged to address scalability and customization limitations of Layer 1 networks. |

| Core Purpose |

General-purpose, hosting diverse applications. |

Specialized, focused on a single application or use case. |

| Security |

Highly secure due to robust consensus mechanisms and network participation. |

Security depends on individual chain design, sometimes requiring additional measures. |

| Scalability |

Often limited, leading to congestion and high fees. |

Highly scalable as they operate independently with customized throughput. |

| Customization |

Limited customization due to predefined protocols and governance. |

Fully customizable, allowing projects to tailor features to specific needs. |

| Transaction Costs |

Can be high due to network congestion. |

Generally lower, as each appchain manages its own resources. |

| Development Complexity |

Easier to deploy on existing Layer 1 networks. |

Requires setting up an independent blockchain, making development more complex. |

| Network Effects |

Strong, benefiting from large user bases and liquidity. |

Initially weaker network effects, requiring effort to attract users and developers. |

| Governance |

Typically governed by a decentralized community or foundation. |

Projects have full control over governance and updates. |

| Interoperability |

Composability with existing dApps and DeFi protocols. |

Often requires bridges or interoperability solutions. |

| Use Cases |

Suitable for DeFi, NFT marketplaces, and general-purpose dApps. |

Best for high-performance applications like gaming, derivatives trading, and niche ecosystems. |

| Reliance on External Infrastructure |

Relies on the core infrastructure of Layer 1 blockchain providers. |

Independent, with full control over infrastructure and consensus mechanisms. |

| Adoption & Ecosystem Growth |

Easier adoption due to existing communities and developer tools. |

Requires dedicated efforts to build an ecosystem from scratch. |

Understanding the Core Trade-offs: Security vs Performance vs Customization

While making a choice between an AppChain and a Layer-1 blockchain for dApp development, your concern must be on the aspects of security, performance, and customization.

Layer-1 blockchains such as Ethereum, Solana, and Avalanche have solid security anchored by a large number of validators or miners. They are resistant to attacks due to their high degree of decentralization, but this security is at the expense of scalability and gas fees that are too high.

Conversely, an AppChain crypto is specifically built for a particular application—enables developers to add their own security measures. Maintaining the security of a chain application is done either by establishing its own validator network or by benefiting from shared security tools, e.g., those of Polkadot’s parachains or Cosmos’ zones.

Layer-1 networks are likely to suffer from congestion as a result of heavy usage, resulting in slower transactions and increased fees. AppChain, being explicitly for a particular dApp, offers better performance by handling only applicable transactions, which leads to increased throughput and reduced latency.

Layer-1 solutions have less flexibility since they have to serve a wide array of applications. AppChains provide full control over the execution environment, consensus mechanism, and governance model and are best for dApps that need special tweaks that cannot easily be done on a Layer-1 blockchain.

Economic Considerations: Token Economics, Validator Incentives, and Launch Costs